Medical Expenses For Dependent Deductible . Web claiming medical expense deductions on your tax return is one way to lower your tax bill. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. To accomplish this, your deductions must be from. Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that:

from studylib.net

Web claiming medical expense deductions on your tax return is one way to lower your tax bill. Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. To accomplish this, your deductions must be from. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your.

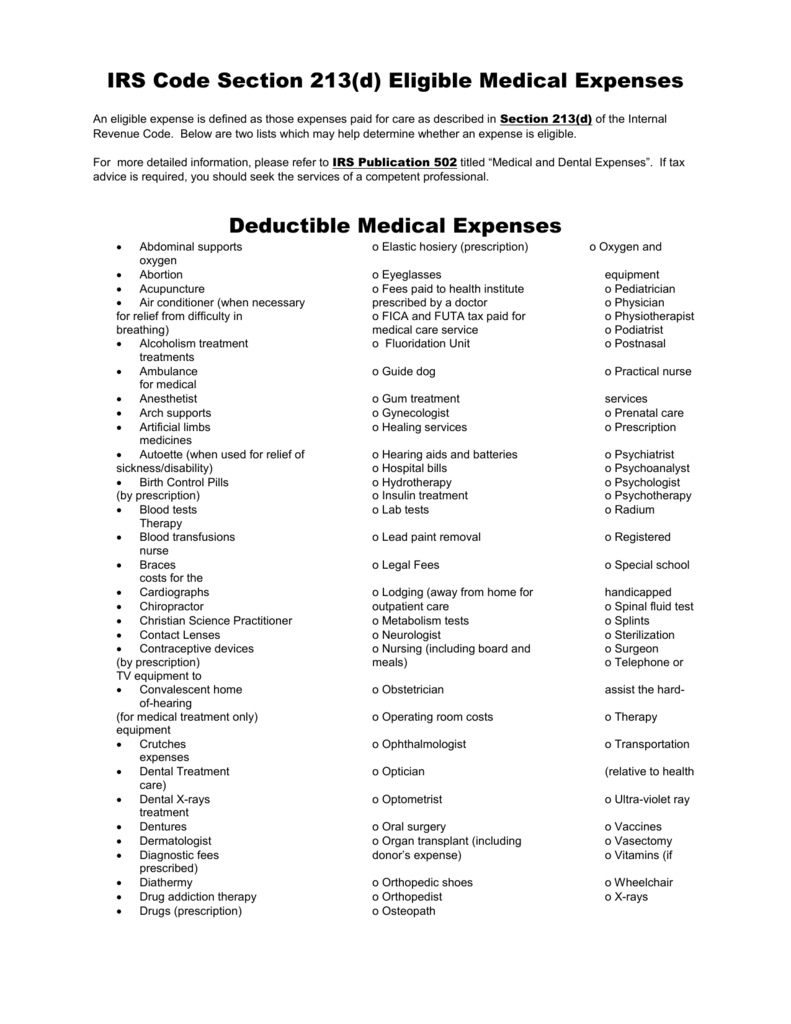

IRS Code Section 213(d) Eligible Medical Expenses Deductible

Medical Expenses For Dependent Deductible To accomplish this, your deductions must be from. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. Web claiming medical expense deductions on your tax return is one way to lower your tax bill. Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. To accomplish this, your deductions must be from.

From www.credello.com

Are medical expenses tax deductible Credello Medical Expenses For Dependent Deductible Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. To accomplish this, your deductions must be from. Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. Web in certain situations, you can deduct medical expenses you paid for an. Medical Expenses For Dependent Deductible.

From besttabletsforkids.org

What medical expenses are tax deductible 2023? Medical Expenses For Dependent Deductible Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. Web claiming medical expense deductions on your tax return is one way to lower your tax bill. Web in certain situations,. Medical Expenses For Dependent Deductible.

From erynqlauryn.pages.dev

Deductible Medical Expenses 2024 Emmie Isadora Medical Expenses For Dependent Deductible To accomplish this, your deductions must be from. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. Web claiming medical expense deductions on your tax return is one way to. Medical Expenses For Dependent Deductible.

From www.blueridgeriskpartners.com

What are Deductibles? Blue Ridge Risk Partners Medical Expenses For Dependent Deductible Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. To accomplish this, your deductions must be from. Web claiming medical expense deductions on your tax return. Medical Expenses For Dependent Deductible.

From www.youtube.com

Are medical expenses deductible? YouTube Medical Expenses For Dependent Deductible Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. To accomplish this, your deductions must be from. Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web if you paid medical expenses for your deceased. Medical Expenses For Dependent Deductible.

From wandamackay.pages.dev

Deduct Medical Expenses 2025 Wanda Mackay Medical Expenses For Dependent Deductible Web claiming medical expense deductions on your tax return is one way to lower your tax bill. To accomplish this, your deductions must be from. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. Web in certain situations, you can deduct medical expenses you paid for an individual. Medical Expenses For Dependent Deductible.

From taxspeed.co.id

Deductible dan Non Deductible Expenses Medical Expenses For Dependent Deductible Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. To accomplish this, your deductions must be from. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. Web in certain situations, you can deduct medical expenses you paid for an. Medical Expenses For Dependent Deductible.

From www.agingcare.com

Can I Deduct Medical Expenses I Paid for My Parent? Medical Expenses For Dependent Deductible Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. To accomplish this, your deductions must be from. Web you can deduct the medical expenses you paid that were incurred. Medical Expenses For Dependent Deductible.

From slideplayer.com

HEALTH SAVINGS ACCOUNTS ppt download Medical Expenses For Dependent Deductible Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. To accomplish this, your deductions must be from. Web claiming medical expense deductions on your tax return. Medical Expenses For Dependent Deductible.

From studylib.net

IRS Code Section 213(d) Eligible Medical Expenses Deductible Medical Expenses For Dependent Deductible Web claiming medical expense deductions on your tax return is one way to lower your tax bill. Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. To accomplish this, your deductions must be from. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or. Medical Expenses For Dependent Deductible.

From www.youtube.com

Are Medical Expenses for workrelated injuries Tax deductible? YouTube Medical Expenses For Dependent Deductible Web claiming medical expense deductions on your tax return is one way to lower your tax bill. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. To accomplish this, your deductions must be from. Web if you paid medical expenses for your deceased spouse or dependent, include them. Medical Expenses For Dependent Deductible.

From www.familyassets.com

TaxDeductible Senior Care Expenses for 2022 Family Assets Medical Expenses For Dependent Deductible Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. To accomplish this, your deductions must be from. Web if you paid medical expenses for your deceased. Medical Expenses For Dependent Deductible.

From www.kpgtaxation.com.au

Medical Expenses Tax Deductible In Australia? Medical Expenses For Dependent Deductible To accomplish this, your deductions must be from. Web claiming medical expense deductions on your tax return is one way to lower your tax bill. Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web you can deduct the medical expenses you paid that were incurred by. Medical Expenses For Dependent Deductible.

From www.taxuni.com

Taxdeductible Expenses What Are They? Medical Expenses For Dependent Deductible To accomplish this, your deductions must be from. Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. Web if you paid medical expenses for your deceased. Medical Expenses For Dependent Deductible.

From www.slideshare.net

Medical expenses4 2011 Medical Expenses For Dependent Deductible Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was your. Web claiming medical expense deductions on your tax return is one way to lower your tax bill. To accomplish this, your deductions must be from. Web if you paid medical expenses for your deceased spouse or dependent, include them. Medical Expenses For Dependent Deductible.

From www.investopedia.com

Medical Expenses Definition Medical Expenses For Dependent Deductible Web claiming medical expense deductions on your tax return is one way to lower your tax bill. To accomplish this, your deductions must be from. Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or. Medical Expenses For Dependent Deductible.

From www.aklerbrowning.com

Yearend planning for medical expense claims Akler Browning LLP Medical Expenses For Dependent Deductible Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web if you paid medical expenses for your deceased spouse or dependent, include them as medical expenses on. Web you can deduct the medical expenses you paid that were incurred by you, your spouse or someone who was. Medical Expenses For Dependent Deductible.

From savingtalents.com

How to Itemize Your Medical Expenses on Your Taxes Saving Talents Medical Expenses For Dependent Deductible Web claiming medical expense deductions on your tax return is one way to lower your tax bill. To accomplish this, your deductions must be from. Web in certain situations, you can deduct medical expenses you paid for an individual who would have been your dependent except that: Web if you paid medical expenses for your deceased spouse or dependent, include. Medical Expenses For Dependent Deductible.